unrealized capital gains tax reddit

You could own outright or be negative equity and the. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

How Should Capital Be Taxed Bastani 2020 Journal Of Economic Surveys Wiley Online Library

If you hold an asset for less than one year and sell for a capital gain the difference.

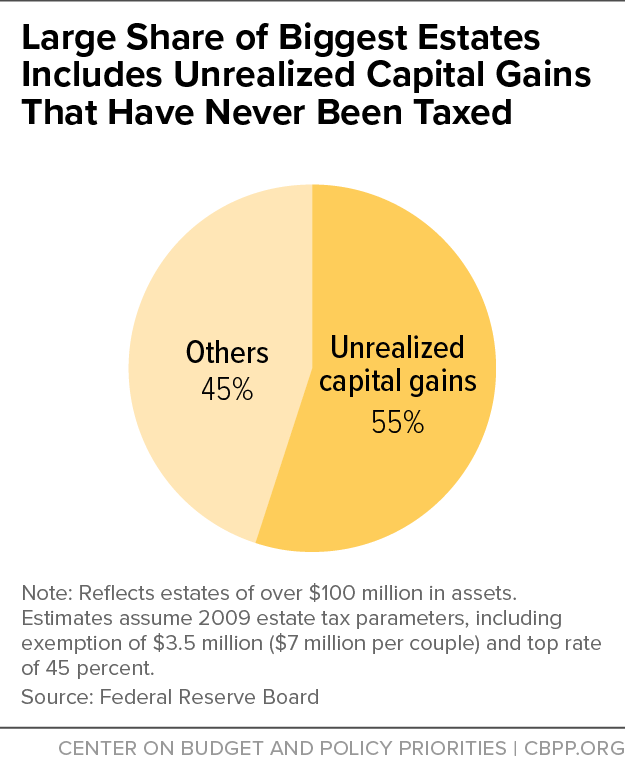

. The unrealized capital gains tax came into discussion in 2021 when Joe Biden and the Democrats found a new way to tax billionaires. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. Find out what happens in the. This is why you.

Then this year youd have unrealized capital gains of 500 in January 0 in August 260 now and who knows in December. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why. Ira Stoll 3282022 350 PM Share on Facebook Share on Twitter.

If youre holding stocks or other assets the act of selling them for a profit or at a loss results in gains and losses. Its a tax thing. If the proposal were to pass.

Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million. He uses it on his farm. Property taxes suck but theyre not unrealized gains taxes.

It is a profitable position that has yet to be sold in return for cash such as a stock. The presidents new budget plan calls on Congress to tax wealthy Americans unrealized capital gains. The Problems With an Unrealized Capital Gains Tax.

So a concrete example will help. He bought it for 20000 from a neighbor. The purpose of this tax was to help the.

Answer 1 of 18. So when is this unrealized capital gains tax due. For one the tax is completely independent of equity.

Farmer Bob has a small tractor. What are unrealized gains. An unrealized gain is a profit that exists on paper resulting from an investment.

Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an unrealized gain.

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

Capital Gains Taxes How To Minimize Them And Why You Might Not Be Able To R Personalfinance

Cmv Unrealized Capital Gains Should Not Be Taxed R Changemyview

Reddit Trader Claims To Make Millions From Risky Tesla Call Options

Eli5 What Is An Unrealized Capital Gains Tax R Explainlikeimfive

Fact Check Posts Get Facts Wrong On Capital Gains Tax Proposal

Finding Opportunities In The Closed End Fund Market Blackrock Commentaries Advisor Perspectives

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk

No U S Won T Tax Your Unrealized Capital Gains Coinmarketcap R Cryptocurrency

Tax Billionaires On Unrealized Stock Gains R Accounting

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Shadypenguinn On Twitter If This Actually Happens There Is No Clearer Image That America S Systems Are Built To Keep The Rich Rich And The Poor Poor Twitter

/cdn.vox-cdn.com/uploads/chorus_image/image/65830630/1191546628.jpg.0.jpg)

Joe Biden S Tax Plan Explained Vox

Unrealized Gains Tax Would Only Target 700 People R Fatfire

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Capital Accumulation And The Reconciliation Package Aier

Stop Worrying About The Unrealized Gains Tax Are You Insanely Wealthy Already No Cool Then It Doesn T Apply To You It S Fud Billionaire Fud R Superstonk