why is aclu not tax deductible

Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. Gifts to the ACLU Foundation on the other hand are deductible because.

What S The Difference Aclu Of Washington

Why Is Aclu Not Tax Deductible.

. The American Civil Liberties Union ACLU is a 501 c 4 a tax -exempt social welfare organization that engages in political andor lobbying efforts to further its mission. Membership dues and other gifts to the american civil liberties union are not tax deductible. You cannot deduct the life insurance policy.

Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the. When you make a contribution to the ACLU you become a card-carrying.

The ACLU is a 501 nonprofit corporation but gifts to it are not tax-deductible. The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. They also enable us to advocate and lobby in legislatures at the federal and local level to advance civil liberties.

Fully funding both is vital to protecting civil liberties Along the way the. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. Membership dues and other gifts to the american civil liberties union are not tax deductible.

This Place Isnt Meant to Help You Get Better. It is the membership organization and you have to be a member to get your trusty ACLU card. Gifts to the ACLU Foundation on the other hand are deductible because.

Gifts to the ACLU Foundation of Massachusetts are. A donor may make a tax-deductible gift only to the ACLU Foundation. Gifts to the ACLU-NJ Foundation are fully tax-deductible to the donor you can make a tax-deductible donation here.

Why is aclu not tax deductible. As other answers have noted the ACLU proper is a tax-exempt organization per section 501c4 of the Internal Revenue Code. The aclu locks in in administrative campaigning.

Answer 1 of 6. How much can you claim on taxes for donations. The main ACLU is a 501c4 which means donations made to it are not.

The tax ID of the American Civil Liberties Union. Contributions to the American Civil Liberties Union are not tax deductible. It is the membership organization and you have to be a member to.

You can defend and advance civil liberties by donating to either the american civil. These organizations are not considered to. Making a gift to the ACLU via a wire transfer allows you to have an immediate impact.

To make a bequest that qualifies for a federal estate tax charitable deduction you may direct your gift to the ACLU Foundation as follows. The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible. Is the aclu an organization that falls under charitable donations.

The aclu locks in in administrative campaigning. The aclu foundation is a 501c3 nonprofit which means donations made to it are tax deductible.

Planned Giving Aclu Of Maryland Aclu Of Maryland Exists To Empower Marylanders To Exercise Their Rights So That The Law Values And Uplifts Their Humanity

Faqs American Civil Liberties Union

Aclu Goes Missing In Civil Liberties Hour Of Need

Aclu Banning Abortion Is Bad For Business Woof Boom Radio News

What S The Difference Aclu Of Washington

2011 Kandler Memorial Dinner Aclu Delaware

Home American Civil Liberties Union

Aclu Of Colorado Home Facebook

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets

Home American Civil Liberties Union

Defend Liberty And Justice New York Civil Liberties Union Aclu Of New York

Aclu Of Illinois Thomas Richie

Aclu Of Colorado Home Facebook

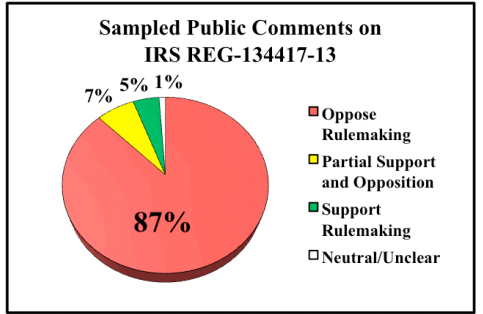

Overwhelmingly Opposed An Analysis Of Public And 955 Organization Ifs

Ways To Give Aclu Of Maryland Aclu Of Maryland Exists To Empower Marylanders To Exercise Their Rights So That The Law Values And Uplifts Their Humanity